Our PayPal Processing Service

️

️

Drive Profit with Whitelisted PayPal

-

Boost Conversion & Revenue

Higher authorization rates translate directly into more completed orders. Even a small uptick in approvals can equate to thousands in incremental sales each month. -

Eliminate Surprises

Dedicated accounts mean predictable operations—no sudden holds, freezes, or account reviews that can stall your business and erode customer trust. -

Reduce Costs

Fewer declines, faster payouts, and lower FX spreads all contribute to improved net margins. Our transparent fee structure ensures you know exactly what you’ll pay. -

Scale Confidently

As your PayPal volume grows, our whitelisted framework scales with you—without risking account health or needing repetitive re-verifications.

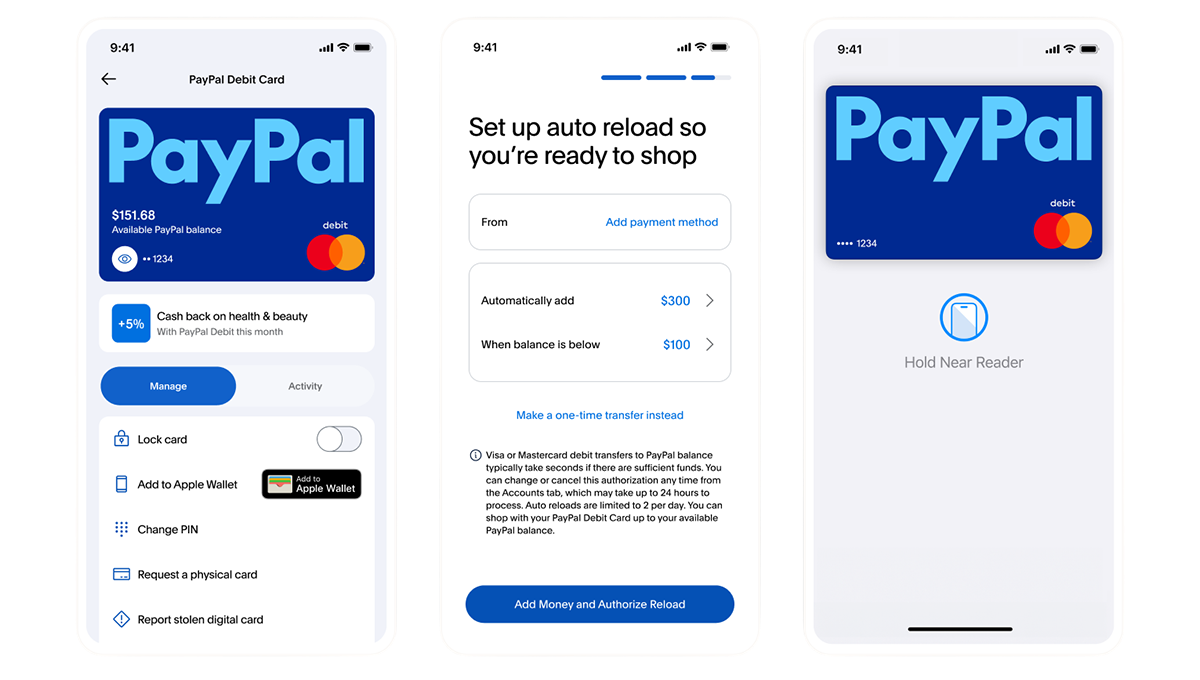

Branded PayPal Checkout Experience

Deliver a seamless, on-brand PayPal checkout that integrates directly into your website or app. Customize the look and feel to match your corporate identity, ensuring customers enjoy a consistent journey from add-to-cart through payment confirmation.

-

Quick-to-deploy PayPal button and pop-up flow, requiring minimal development effort yet retaining full branding options.

-

Fully tailor the payment UI—colors, fonts, layout—and embed PayPal fields inline for a truly native customer experience.

PayPal API & Integration Tools

Plug every PayPal function directly into your systems via our RESTful endpoints and webhooks:

-

Order & Payment Management – Create orders, capture funds, process refunds, and schedule payouts programmatically.

-

Real-Time Notifications – Receive instant webhooks on authorizations, captures, disputes, and chargebacks for instant reconciliation.

-

Dashboard Controls – Use our unified interface to monitor activity, adjust settings, and troubleshoot issues without switching platforms.

Dispute & Risk Management

Protect revenue and reputation with PayPal-specific fraud filters and streamlined dispute workflows:

-

Automated Fraud Screening – Leverage machine-learning models tuned for PayPal to block high-risk transactions before they hit your books.

-

Chargeback Resolution – Centralize evidence collection, submission, and status tracking so you resolve disputes faster and preserve account health.

-

Compliance & Reporting – Stay audit-ready with detailed logs, transaction histories, and KYC/AML support tailored to PayPal’s requirements.

Recent Posts

- January 25, 2024

- Business

What’s Holding Back the Payment Solutions Industry?

- January 30, 2024

- It Service

Meet Smashing Book Frontiers Web For Better.

- February 4, 2024

- Business