Our Virtual and Physical Cards Service Overview

Choose Your Prefer Method

TTRPay’s Virtual Account / Card service delivers instant-access virtual bank accounts with local account details and on-demand virtual credit cards designed for global ad spend, all backed by an uncapped cashback rewards program and enterprise-grade security.

Tailored Virtual Account / Card Solutions Await You

At TTR Pay, we empower you to manage global cash flow and ad spend in one unified platform—complete with enterprise-grade security and automatic cashback.

Whether you’re a startup scaling rapidly or a global brand managing multi-channel campaigns, our platform gives you real-time visibility, seamless integration with your favorite tools, and intelligent insights to optimize every dollar. With TTR Pay, you stay in control, reduce financial friction, and unlock growth — all from a single, streamlined dashboard.

Technology & Management Tools

Virtual Account API

Our API delivers full lifecycle control over virtual accounts:

Issue or close IBANs on demand

Automate reconciliation and fund sweeps

Retrieve transaction history and balance snapshots

Virtual Card API

Seamlessly manage your VCC program:

Instant card issuance and replacement

Dynamic spend limits and merchant filters

Real-time transaction notifications

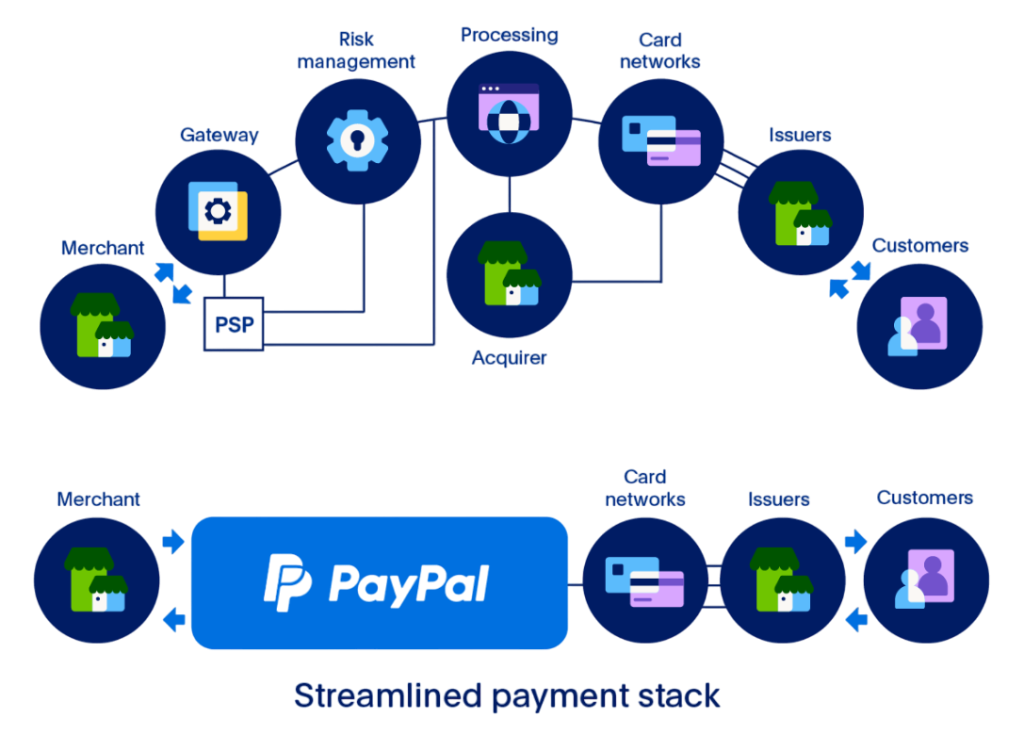

Pay-in & Pay-out Processing

TTR Pay’s in-house processing engine routes incoming and outgoing transfers through local rails in 170+ markets. Enjoy:

Real-time settlement into your virtual accounts

Automated foreign-exchange at competitive rates

Detailed reporting and customizable payout schedules

This end-to-end solution simplifies your global treasury, so you can deploy capital and track spend with complete transparency.